Showing posts with label Carry Trade. Show all posts

Showing posts with label Carry Trade. Show all posts

Monday, July 4, 2011

The Operations "carry trade" Part-3

This trend leads to a significant increase in financial markets, coupled with a loss of the concept of risk in the minds of market players due to a depletion of non cash flow. However, a decline in performance in the financial markets, a sudden reversal of the markets, would cause substantial losses for investors, given the high level of leverage and risk now supported in the carry trade. Such a situation would cause a repositioning of investors and a concomitant rapid unwinding of positions in many currencies.

The decrease in the level of liquidity resulting from this movement would affect all markets and could be the detonator of a currency crisis or a global economic crisis in the world.

The same situation was experienced in 1997-1998 in Asia, while the yen carry trade operations were already in place and that the Russian market, to be distributed, had fallen sharply. Today the extent of yen carry trade is more important and the crisis would reach Europe and the United States, countries in which investments are made.

In a context of continued increase in European markets and U.S. growth of risk borne by financial transactions recently implemented, Japanese monetary policy is closely watched by central banks. To prevent slippage of financial markets, a gradual closing of the "tap" cash is needed and must go through a rate hike. However, the continued movement deflation in Japan does not justify a significant rise in interest rates. Japan cannot afford to hire a real policy of monetary tightening; the Bank of Japan announced Feb. 21 an increase in the rate of 0.25% and should not go much further in the short term.

Several questions arise: what are today the real levers available to the Bank of Japan? Central banks have they yet have the means to weigh on global liquidity? Is it too late to avoid the worst?

The Operations "carry trade" Part-2

Currently, the carry trade the most developed is the yen carry trade, however, note that there are also such operations on the Swiss franc. For investors, the yen carry trade is interesting on two levels: first because of the difference in rates (the Bank of Japan lends at a rate of 0.25%, while investors can invest this money to rates above 5% in England and the United States); the other due to the depreciation of the yen during the duration of the operation.

The situation faced today was introduced by Japan's economic policy. Following the crisis of the 2000s, Japan and the United States and Europe have dropped their rates significantly in order to avoid an economic slump. However, if the United States and Europe have been sharply reversed the trend, growth in Japan that has developed since then have been accompanied by a sharp reduction in unemployment, low wage growth but to no inflationary pressures, the Bank of Japan was not forced to change its monetary policy and rates remained extremely low (0.25%).

The interest rate spread, which has gradually opened up between the rates of Western central banks and the Bank of Japan caused the yen carry trade phenomenon. The main actors are just to take this opportunity, especially as comfortable as it is artificially maintained by the Japanese central bank and no sign of change seems to appear.

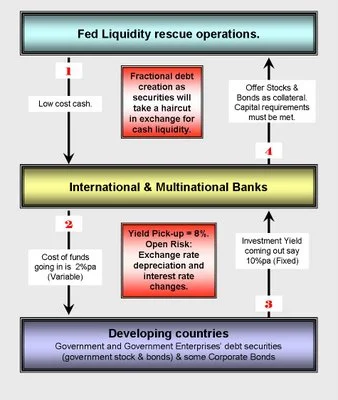

The current danger is that the carry trade is no longer limited to play on differences in rates, but it greatly increases the global liquidity by moving the pockets present in economies with weak currencies to countries with high rates. The yen is borrowed in dollars, pounds sterling, Euros ... then invested in operations with high leverage.

The Operations "carry trade" Part-1

The port - or carry trade - is a relatively simple operation which is to take advantage of a gap in performance between asset classes: asset borrowed at low rates are placed in high-yield assets. Today, the phenomenon has grown strongly on the yen, becoming problematic. that evidenced by recent calls from the President of the Eurogroup, Jean-Claude Juncker, and many analysts, asking the President of the Bank of Japan to reconsider its policy. They do not seem to find echoes in Japan, but show an awareness of the danger generated. However, failure to report the problem exists at the conference of the G8 does not seem to be in line for a quick response.

The carry trade exchange, a concept theoretically unworkable in the long term. A currency carry trade involves borrowing in a currency in a country where rates are low, to change the money into a currency "strong" and place it high (treasuries ...). Theoretically, the operation of the arbitration process is ephemeral because the markets are efficient (at each moment is a financial security to its price) and rebalance through exchange rates and interest rates.

In addition, because of the rule of parity uncovered interest rate, the interest of such an operation is theoretically zero. Indeed, a difference in rates between two countries reflects inflation differentials. But these differences are offset by a realignment of exchange rates. Thus, when an investor speculates on the difference in rates observed between the two countries, he loses the same value on the exchange. That said, sometimes the law does not hold in practice and that the currencies of countries with low rates and suffer the opposite effect depreciate. This is the case of the yen, which reached historic lows against the U.S. dollar and the euro.

Thursday, June 16, 2011

Carry Trade Part.III

This trend leads to a significant increase in financial markets, coupled with the disappearance of the concept of risk in the minds of market players due to a depletion of non cash flow. However, a decline of return on financial markets, a sudden reversal of the market, would result in substantial losses for investors, given the high level of leverage and risk now borne in the carry trade. Such a situation would cause a repositioning of investors followed by a rapid and concomitant unwinding of positions in many currencies.

The lower level of liquidity resulting from this movement would affect all markets and could be the detonator of a global currency crisis or a global economic crisis. The same situation was experienced in 1997-1998 in Asia while the yen carry trade operations had already been implemented and that the Russian market, object placement, had fallen sharply. Today the extent of yen carry trade is more important and the crisis would reach Europe and the United States, countries in which investments are made.

Against a backdrop of continued increase in U.S. and European markets, increasing the risk borne by financial transactions recently introduced, the Japanese monetary policy is closely watched by central banks. To prevent slippage of the financial markets, a gradual closing of the "tap" cash is needed and must go through a rate hike. However, the continued movement deflation in Japan does not motivate a significant rise in interest rates. Japan cannot afford to hire a genuine policy of monetary tightening; the Bank of Japan announced Feb. 21 an increase of 0.25% and should not go much further in the short term.

Several questions arise: what are today the real levers available to the Bank of Japan? Central banks have they any means to influence the global liquidity? Is it too late to avoid the worst?

Carry Trade Part.II

Since last few years, the carry trade is the most developed of the yen carry trade, however, note that they are also processed the Swiss franc.

For investors, the yen carry trade is interesting on two levels: firstly because of the difference in rates (the Bank of Japan lends at a rate of 0.25%, while investors can invest this money to rates above 5% in England and the United States), secondly because the yen's depreciation during the duration of the operation.

The situation faced today was introduced by Japan's economic policy. Following the crisis of the 2000s, Japan and the United States and Europe have dropped their rates sharply to avoid an economic slump. However, if the United States and Europe have been sharply reversed the trend, growth in Japan that has developed since then have been accompanied by a significant reduction of unemployment, low wage growth but to no inflationary pressures, the Bank of Japan was not forced to change its monetary policy and rates remained extremely low (0.25%). The yield spread, which has gradually opened up between the rates of Western central banks and the central bank has caused the Japanese yen carry trade phenomenon. The main actors are not taking advantage of that opportunity, the more comfortable it is artificially maintained by the Japanese central bank and no sign of change seems to appear.

However, significant risks facing the global economy. The current danger is that the carry trade is no longer limited to playing on differences in rates, but it greatly increases the global liquidity moving into the pockets present in economies with weak currencies to countries with high rates. The yen is borrowed in dollars, pounds sterling, Euros ... then invested in operations with high leverage.

Wednesday, June 15, 2011

Carry Trade Part.I

The asset borrowed at low rates is placed in high-yield assets is otherwise called Carry trade. Today, the phenomenon has grown strongly over the yen and becomes problematic. Many analysts calling the Banks to reconsider their policy. They do not seem to find echoes in Japan, but show an awareness of the danger generated. However, non-termination of existing problem at the G8 conference does not seem to go in the direction of a rapid response. The carry trade exchange, a concept theoretically unworkable in the long term.

A carry trade involves borrowing in foreign exchange currency in a country where rates are low, to change this amount in a currency "strong" and place it at high rates (treasury bills ...). Theoretically, the operation of the arbitrage transaction is ephemeral because the markets are efficient (at each moment is a financial security to its price) and rebalance through exchange rates and interest rates.

Moreover, because of the rule of parity uncovered interest rate, the interest of such an operation is theoretically zero. Indeed, a difference in rates between two countries reflects inflation differentials. But these differences are offset by a realignment of exchange rates. Thus, when an investor speculates on the difference in rates between two countries, he loses the same value on the exchange. That said, sometimes the law does not hold true in fact and that the currencies of countries with low rates suffer the opposite effect and depreciates. This is the case on the yen, which reached historic lows against the U.S. dollar and the euro.

Subscribe to:

Comments (Atom)