Tuesday, July 5, 2011

Subprime Loans and Crisis Management Part.2

In recent past the two assumptions above are not true:

* Declining housing market reduces the value of the mortgaged property falls below the debt

* Rising interest rates makes debt burden too heavy for a fragile population.

Moreover, these loans were sold with an initial period of 2 or 3 years with a fixed prime. Loans issued in 2004 and 2005 (time of highest award) so arrive at the end of this period and must be reattached in 2007, triggering a wave of defaults.

If the mechanism occurs on a large scale, the financial institution as a whole is threatened.

To optimize their use of capital, banks that granted these loans have securitized all or part of their subprime loans primarily through CDO or RMBS and this, with the blessing of most credit rating agencies.

Yields offered have attracted all investors: hedge funds but also the more traditional asset managers. Funds that meet today's challenges are mainly dynamic money market funds, which could offer higher yields, not more sophisticated hedge funds.

Defects increasing the sub primes, the value of credit derivatives is greatly reduced. The managers are then unable to calculate the value of their background, including lack of exchange of the instruments. They then suspend trading, causing investor panic. They wish to sell then all turn, forcing managers to temporarily close the funds until better days.

The funds that have affected not closed had to find cash to meet withdrawals; they then sold the only liquid assets, the shares resulting in lower market share.

Finally, some banks are highly exposed through their funds (including the German bank Sachsen LB, IKB, BBW, etc...) Must meet their losses and introduce and suspicion on the entire area causing tensions in the interbank market.

Subprime Loans and Crisis Management Part.1

In early summer, those fears were fueled by a potential overheating in China and more widely within the BRICs. But it is the first economic and financial power that the crisis began. The crisis is termed as "subprime loans" in the United States.

Indeed, the media outburst is over from negative expectations that cannot be definitely confirmed that over the medium term.

The loans are subprime mortgage loans to counterparties particularly risky, satirically nicknamed "NINJA" (No Income, No Job or Asset). These loans are secured by the good they have to acquire and pay high interest rates that can exceed 10%.

The difficulties faced by two million borrowers in the U.S. and the resulted crisis is the result of two factors:

1. shortcomings in terms of risk assessment borrowers

2. an extensive use of securitization

Origin of the crisis: a failure in terms of risk assessment borrowers

The montages were created based on two strong assumptions:

* Interest rates are permanently down for the duration of the funding that exceeds 25 years in most cases,

* The loan amount is based on a steady growth in the future value of the asset financed.

Funding in place thus follows a logical assessment of market risk (the value of the asset financed), not a logical assessment of credit risk (the risk assessment of default by the borrower) as it is common, especially with the introduction of regulatory reforms such as Basel II credit. Out the regulatory environment in the United States does not in this sense, since they are only 20 large banks operating internationally, which will comply with Basel II. Other credit institutions will be subject to a lighter frame (called Basel IA), whose implementation is planned for 2009 (2007 in Europe).

Monday, July 4, 2011

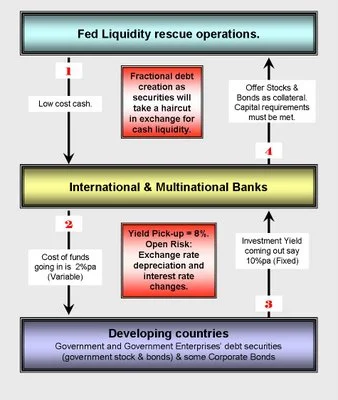

The Operations "carry trade" Part-3

This trend leads to a significant increase in financial markets, coupled with a loss of the concept of risk in the minds of market players due to a depletion of non cash flow. However, a decline in performance in the financial markets, a sudden reversal of the markets, would cause substantial losses for investors, given the high level of leverage and risk now supported in the carry trade. Such a situation would cause a repositioning of investors and a concomitant rapid unwinding of positions in many currencies.

The decrease in the level of liquidity resulting from this movement would affect all markets and could be the detonator of a currency crisis or a global economic crisis in the world.

The same situation was experienced in 1997-1998 in Asia, while the yen carry trade operations were already in place and that the Russian market, to be distributed, had fallen sharply. Today the extent of yen carry trade is more important and the crisis would reach Europe and the United States, countries in which investments are made.

In a context of continued increase in European markets and U.S. growth of risk borne by financial transactions recently implemented, Japanese monetary policy is closely watched by central banks. To prevent slippage of financial markets, a gradual closing of the "tap" cash is needed and must go through a rate hike. However, the continued movement deflation in Japan does not justify a significant rise in interest rates. Japan cannot afford to hire a real policy of monetary tightening; the Bank of Japan announced Feb. 21 an increase in the rate of 0.25% and should not go much further in the short term.

Several questions arise: what are today the real levers available to the Bank of Japan? Central banks have they yet have the means to weigh on global liquidity? Is it too late to avoid the worst?

The Operations "carry trade" Part-2

Currently, the carry trade the most developed is the yen carry trade, however, note that there are also such operations on the Swiss franc. For investors, the yen carry trade is interesting on two levels: first because of the difference in rates (the Bank of Japan lends at a rate of 0.25%, while investors can invest this money to rates above 5% in England and the United States); the other due to the depreciation of the yen during the duration of the operation.

The situation faced today was introduced by Japan's economic policy. Following the crisis of the 2000s, Japan and the United States and Europe have dropped their rates significantly in order to avoid an economic slump. However, if the United States and Europe have been sharply reversed the trend, growth in Japan that has developed since then have been accompanied by a sharp reduction in unemployment, low wage growth but to no inflationary pressures, the Bank of Japan was not forced to change its monetary policy and rates remained extremely low (0.25%).

The interest rate spread, which has gradually opened up between the rates of Western central banks and the Bank of Japan caused the yen carry trade phenomenon. The main actors are just to take this opportunity, especially as comfortable as it is artificially maintained by the Japanese central bank and no sign of change seems to appear.

The current danger is that the carry trade is no longer limited to play on differences in rates, but it greatly increases the global liquidity by moving the pockets present in economies with weak currencies to countries with high rates. The yen is borrowed in dollars, pounds sterling, Euros ... then invested in operations with high leverage.

The Operations "carry trade" Part-1

The port - or carry trade - is a relatively simple operation which is to take advantage of a gap in performance between asset classes: asset borrowed at low rates are placed in high-yield assets. Today, the phenomenon has grown strongly on the yen, becoming problematic. that evidenced by recent calls from the President of the Eurogroup, Jean-Claude Juncker, and many analysts, asking the President of the Bank of Japan to reconsider its policy. They do not seem to find echoes in Japan, but show an awareness of the danger generated. However, failure to report the problem exists at the conference of the G8 does not seem to be in line for a quick response.

The carry trade exchange, a concept theoretically unworkable in the long term. A currency carry trade involves borrowing in a currency in a country where rates are low, to change the money into a currency "strong" and place it high (treasuries ...). Theoretically, the operation of the arbitration process is ephemeral because the markets are efficient (at each moment is a financial security to its price) and rebalance through exchange rates and interest rates.

In addition, because of the rule of parity uncovered interest rate, the interest of such an operation is theoretically zero. Indeed, a difference in rates between two countries reflects inflation differentials. But these differences are offset by a realignment of exchange rates. Thus, when an investor speculates on the difference in rates observed between the two countries, he loses the same value on the exchange. That said, sometimes the law does not hold in practice and that the currencies of countries with low rates and suffer the opposite effect depreciate. This is the case of the yen, which reached historic lows against the U.S. dollar and the euro.

Subscribe to:

Posts (Atom)